Personal finances, investments, registering a company, tax issues and real estate management are areas that are often difficult to navigate in Japan. J SELECT is proud to introduce English speaking professionals that can help guide you in any number of financial and regulatory processes. These specialists operating across Japan from the greater Tokyo area, can help you chart the best course for your personal financial future.

Banner Asset Management

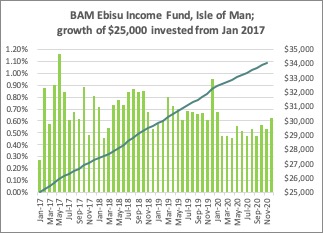

Where can you get a secure investment that is going to pay you 6-10% safely?

Finding yield is tough right now, with 10-year bond rates and worldwide national Reserve Banks’ benchmark interest rates all at record lows.

At Banner Asset Management we make money every month through a simple and robust system that we are happy to explain and share.

Since Inception we have earned 37.10% to Dec 2020 an average of 9.27% p.a.

The fund is set up with safety of invested capital as first priority. It lends money to medium sized builders with loans ranging from $10 million to $50 million. The builders need loans in order to complete their building projects. The fund does not invest in property: the fund lends money against specified collateral at LTVs usually below 75%. Australian law is clear on defaults: the fund takes the collateral and sells it. The loans are made for between 12 and 24 months, and as there are typically 20 to 25 loans in play at any one time. Repayments come back into the fund on a regular basis — thus forestalling liquidity issues, which are the Achilles heel of most property funds. Ebisu is not a property fund; it is a loan fund pure and simple.

For more information contact Banner 03-5724-5100 or info@bannerjapan.com

In addition, Banner Asset Management can also provide a tax efficient wrapper which shields Capital gains Taxes. With the OECD’s Common Reporting Standard (CRS) in place, more and more of their financial data gets automatically exchanged, so it is good for the Aussie, European, U.K. and the authorities here in Japan (which joined the CRS in September 2018). If funds are held in an insurance wrapper, they can be easily reported but aren’t taxable unless you take a profit out (this means all capital gains are shielded from taxes). At the point where one decides to take things out one can plan to take advantage using the best tax friendly jurisdiction possible to mitigate as much tax as possible.

For more information contact Banner 03-5724-5100 or info@bannerjapan.com

For more information contact Banner 03-5724-5100 or info@bannerjapan.com

Banner Asset Management Japan

http://www.bannerjapan.com/

AP Advisers Limited

Since 2004, AP Advisers Ltd. has established an unrivaled reputation for unbiased, professional advice and service. They listen closely to your financial objectives and tailor solutions specifically for your needs. They take charge of your financial affairs leaving you to make the most of your life and career.

AP Advisers‘ success is based on two core principles. Firstly developing long-term client relationships with a focus on superior service. Secondly, their fee structure is transparent and connected to the success of your investment portfolio, ensuring the client-adviser relationship is positioned to be mutually beneficial.

There are good reasons why so many clients have entrusted their wealth management to AP Advisers. Innovative, and unique but straightforward financial solutions to assist them in achieving their long-term financial goals. No nonsense, clear advice clients from all walks of life can understand. From novice investors to professionals, clients benefit from over 50 years’ collective experience between their highly trained, ethical and professional advisers who put clients’ best interests first. Initial consultations are free with no obligation and include a tailored advisory report to help you get on track to achieving financial independence. Services include:

* Wealth Accumulation; building a future nest egg from disposable income.

* Wealth Accumulation; building a future nest egg from disposable income.

* Wealth Management; deploying your accumulated cash for better returns whether you seek capital growth or income.

* Switchmaster; unique to AP Advisers, a “robo-adviser” hybrid to identify the best performing assets available from within your investment account. Be in the right place at the right time to make your moves and see your wealth grow quicker.

* Retirement Planning; targeted strategies to ensure you are in command of when you wish to retire, and to take the “need” out of work.

* College Fee Planning; setting aside capital or accumulating a pot from disposable income to ensure your children have access to the best higher education.

* Wills; via outsourced services, formalize your last wishes to ensure your wealth is passed in an efficient and timely manner.

* Property Finance; via external brokers who specialize in sourcing mortgages for the purchase or refinance of properties in Japan and the U.K.

* U.K.-based Independent Financial Advisers; Are you a British Expat or former resident with U.K-based assets, or are about to return to the U.K.? AP Advisers has strategic partnerships with U.K-regulated IFA’s who provide specialist advice for your circumstances.

Past performance of investments are no guarantee to future returns and you may not get back the money you invested, especially if you liquidate in the short-term. They suggest you adopt an investment horizon of at least 5-10 years. AP Advisers is registered as an investment adviser with the Kanto Finance Bureau, No. 487.

For more information contact AP Advisers 03-3436-2004 or info@ap-advisers.com

For more information contact AP Advisers 03-3436-2004 or info@ap-advisers.com

AP Advisers Ltd.

8F Shimbashi Kato Bldg, 5-26-8 Shimbashi, Minato Ku, Tokyo 105-0004

https://www.ap-advisers.com/

Axios Management Inc.

Axios Management is focused on supporting foreign investors in Japan and offer a full range of customized property management services aiming to both maximize owners ROI and protect their interests.

PROPERTY ANALYSIS

Market Survey and Planning

Axios Management carries out extensive data collection on local demographics, market trends and investor sentiment. They perform in-depth analysis using this information, allowing them to identify optimum marketing strategies and target tenant profiles.

Market Analysis

The professionals of Axios Management compare their client’s properties to similar offerings, whilst also incorporating long-term trends and macroeconomic factors in the analysis.

Property Audit

Every property has its own unique characteristics. Before putting them on the market, they carry out a comprehensive audit to identify ways of adding value.

Property Enhancement

Axios Management has access to a strong network of highly skilled and experienced contractors. Through this they can commission cost effective and profitable improvements to properties.

Continuous Property Analysis

Axios Management professionals take a proactive approach to property management and continuously identify any issues that arise. These are resolved expeditiously at an early stage to avoid inconveniencing both landlords and tenants.

Potential Added Income

Their comprehensive property audits can identify areas of improvement to optimize both revenue and capital appreciation for landlords.

ONSITE MANAGEMENT

Onsite Management

They employ professional property managers with extensive industry experience. These property manager’s job is to liaise with tenants on a regular basis, identifying problems as they arise and enforcing lease terms where necessary.

Maintenance

Axios Management carries out maintenance and repairs as soon as their managers identify problems or tenants notify them. They use a strong network of highly skilled, certified and experienced contractors, all of which have a long-term track record of service with Axios Management.

Rent Collection

Their property managers are responsible for monitoring rental income. Any arrears, disputes or potential breaches of contract are escalated immediately to senior management for remedial action.

OFFSITE MANAGEMENT

Offsite Management

Offsite Management

The Axios Management team handles the legal and financial administration of client properties, working in close collaboration with both on-site property managers and clients.

Property Reports

To deliver a high level of transparency, Axios Management provides clients with regular update reports on their investments.

Tenants Screening and Leasing

Axios Management undertakes a rigorous screening process of potential tenants and matches their background with your needs. Their methods ensure that clients are presented with high quality tenants that fit your criteria.

TAX REPRESENTATION AND FILING SERVICES

Axios Management acts on behalf of clients as their official tax representative. In this capacity, Axios Management prepares the documents required for income tax declarations, translation and registration with the tax authorities.

Axios Management ensures clients are compliant with the tax regulations in Japan and provide ongoing advice in this complex area.

For more information contact Axios Management 050-1742-4810 or https://www.axm.co.jp/contact/

For more information contact Axios Management 050-1742-4810 or https://www.axm.co.jp/contact/

Axios Management

#1201 Shinagawa Center Building 3-23-17 Takanawa, Minato-ku Tokyo, 108-0074

https://www.axm.co.jp/japan-property-management/

CAPITAL TAX K.K.

Do you have issues doing business in Japan?

Perhaps you want to set up a new company; there are a lot of documents required to register a company (GK, KK, Representative Office) or subsidiary in Japan. CAPITAL TAX LTD. has staff specialized in establishing new companies and can eliminate the hassle of registering a new company. Perhaps you need accounting and payroll services for your staff in Japan. Regardless of the size of your company CAPITAL TAX LTD. can meet your accounting needs from daily bookkeeping to monthly payroll. Perhaps you’ve struggled with filing a corporate tax (hojinzei) or consumption tax (shohizei)? Calculating corporate tax and consumption tax is very complicated. You’ll need proper understanding of tax law and experience, to avoid any unexpected losses due to fines and improper filings.

Common questions include:

– What can be considered as an expense when calculating corporate tax?

– Are transactions with foreign companies subject to consumption tax?

– What about withholding tax systems?

If you struggle to answer any of these, contact CAPITAL TAX LTD. immediately! They have well-experienced specialists who can advise and fully support your tax needs. With their knowledge and expertise, they can file these forms accurately and smoothly on your behalf.

CAPITAL TAX LTD. can also go one step further to advise you on employees’ social insurance as well, from changes in dependency status, to marriages and child care leave. Some of these procedures are entirely unique to Japan and failure to comply with established Japanese labor laws could mean big fines for your business. Their experts will carefully explain the scope of what is considered necessary by the Japanese government so you will be safe from any unexpected issues.

If you are struggling with personal taxes in Japan as a self-registered employee, renting real estate in Japan, wish to exercise stock options in your company, or simply make over ¥20 million per year, you may need the advice of a professional to file your taxes properly. In all these situations filing taxes in Japan can be messy and confusing, and the extent to which you should file depends on how long you have been in Japan, in addition to a host of other factors. But with the services available through CAPITAL TAX LTD., they can help you prepare your tax return properly and you can avoid all of the hassle and get back to living stress free.

As an added bonus CAPITAL TAX LTD.’s services are available not only in Japan, but in Vancouver, Hong Kong, and Shanghai as well. They can professionally inform and advise you on a wide range of international tax regulations, saving you or your company time and money.

Check out their other services too, including:

– U.S. Expat Tax Services (1040, 2555, Form 5471, FBAR)

– Non-Resident Taxation

– Tax Audit Assistance

And more…!

If you are interested in their services, feel free to contact them below!!

For more information contact CAPITAL TAX LTD. 03-6890-3036 or yoshie@capitaltaxltd.com

For more information contact CAPITAL TAX LTD. 03-6890-3036 or yoshie@capitaltaxltd.com

CAPITAL TAX LTD.

4F Akasaka K-Tower, 1-2-7, Moto-Akasaka, Minato-ku, Tokyo, Japan 107-0051

https://www.capitaltaxltd.com/japan/

Recent Comments