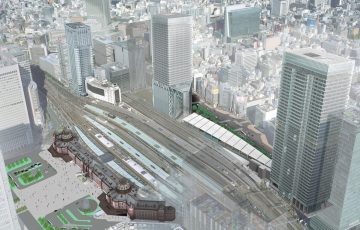

The Tokyo Sky Tree. A lot has been said and written about the new broadcasting tower which is set to become the tallest artificial structure in Japan, but one thing amazes no matter how often it is heard – the sheer size of it. At 634 meters, or 2,080 feet in old world money, it will be quite literally scraping the sky above Oshiage.

The Tokyo Sky Tree. A lot has been said and written about the new broadcasting tower which is set to become the tallest artificial structure in Japan, but one thing amazes no matter how often it is heard – the sheer size of it. At 634 meters, or 2,080 feet in old world money, it will be quite literally scraping the sky above Oshiage.

2,000 feet is big enough to be called a mountain in Britain. In fact, mountains over 2,000 feet in England even have a special name: Nuttalls. Some people become obsessed with climbing every Nuttall in the land. It’s a hobby, a day out, a long hard hike – not a digital TV tower. The point is that the size of the construction, and that of the city it will soon tower over, is a total anomaly. Big is not something Japan usually does. Japan does small and does it very well.

From electronics to capsule hotels, Japan has always been about trying to get the most out of every inch of space. This is usually attributed to the constrictions of so many people living in such close proximity to each other. Travel into the Japanese countryside and you will find a lot of it sparsely inhabited, if inhabited at all. The reason for this is simply that it is largely uninhabitable – steep slopes prone to failure make for poor house building. Thus, most people are left to eke out an existence on the narrow coastal plains, and hence the necessity (the mother of invention as everyone knows) of miniaturization.

In relation to property, miniaturization means how to get more out of a small piece of land. This usually means building up, but on an even smaller scale it means fitting more units into a single building. Thus, whether residential or commercial, Japan’s properties are not exactly renowned for their roominess. As anyone who has ever lived in a 1DK apartment in the land of the rising average age can testify, there is enough room to swing the veritable cat, but perhaps not a greyhound, veritable or otherwise.

The situation doesn’t just apply to apartments the size of bathrooms, though. Tokyo has the most expensive office space in the world. Sure, for aspiring entrepreneurs and small businesses, a small office will do just fine, but for small offices in Tokyo you might want to take a deep breath when you go in… and hold it.

Location, location, location. In the property world, nothing is more important. For aspiring businesses in big cities, it might more correctly be termed ‘address, address, address.’ A pristine Marunouchi or Westminster address after your company name goes a long way to lending you some prestige, and the convenience of such central locations makes them undeniably attractive. There’s just one small problem, though – money, lots of it.

Let’s imagine a scenario – you’ve got your big idea all thought out, your startup capital prepared and customers kicking down the door to get to you. The only thing left to do is set up an office. Now, let’s see… last year, on average, a square foot of London’s West End would have set you back about $170 a year, while Tokyo was even more expensive at $180. That is going to put a nasty dent in any budget, unless you make sure to only hire people who watch their weight and are fairly comfortable with lots of physical contact.

Let’s imagine a scenario – you’ve got your big idea all thought out, your startup capital prepared and customers kicking down the door to get to you. The only thing left to do is set up an office. Now, let’s see… last year, on average, a square foot of London’s West End would have set you back about $170 a year, while Tokyo was even more expensive at $180. That is going to put a nasty dent in any budget, unless you make sure to only hire people who watch their weight and are fairly comfortable with lots of physical contact.

So, with rents higher than Tokyo Sky Tree, initial costs verging on the vulgar and hundreds of pages of Japanese red tape to be dealt with, getting your office off the ground in Tokyo can be a daunting prospect. There are, however, a couple of options.

Serviced offices have been around for a while and offer fully furnished, IT ready units for short or long term purposes. Many, such as Space Design, have services in English and actively target the foreign company market.

For some, though – startup companies in particular – a serviced office is too big for their needs, and certainly for their budget. Enter the SOHO.

SOHO (Small Office/Home Office) offices cater specifically for the small business market and, as the name suggests, are not particularly large. In Japan, they are even smaller than you could possibly expect. SOHOs have been around for a while but the current crop of micro offices are a product of the recession-hit economy. Building owners around Tokyo are splitting their floor space into smaller and smaller units in a bid to hit back at the struggling market which has seen vacancy rates in regular office buildings hit the roof. Smaller units mean a larger total rent for the building and that owners won’t suffer if one large office space should become vacant.

This trend of micro offices means that the competition among SOHO operators is becoming fierce. Whilst SOHOs were traditionally located in areas like Shinjuku and Shimbashi (which have an abundance of old office buildings) recent developments such as the striking ‘the Soho’ in Odaiba are bucking the trend. From the customer’s point of view, all this competition means a decrease in prices and an increase in facilities. ‘The Soho’ offers its tenants a gym, a bar and even a spa for those who might find the working day just a little bit too stressful. Some SOHO companies are even trying to help their clients socialize by holding business card exchange parties and business seminars for tenants.

It’s not just means of relaxation and networking that are on offer, though. From ¥49,800 a month, Sakura House (http://www.shinjuku-bg.jp/english) lease mind-boggling six by three foot office spaces at various locations around Tokyo. They provide postal office boxes, a bilingual telephone answering service and secretarial staff, plus free internet connection. Best of all, they provide an address for your company in areas such as Shinjuku, Shibuya and Yotsuya. Kazuhiro Aoyama from Sakura House says that the variety of customers they get can be surprising.

“SOHO offices used to be for individual entrepreneurs, but I think the customer’s purpose is becoming diversified. There are companies from rural areas in Japan opening up a branch at a SOHO instead of regular offices to cut costs. We even have students renting a SOHO office to study for university entrance exams, or salary-men studying for some kind of license or certifying examination.”

The other great benefit of SOHO offices is that it won’t break the bank to get your foot in the door. One of the hardest things for foreigners to accept about property in Japan is key money. The severe shortage of housing after World War 2 meant that reikin or gratitude money was essential for anyone wanting to rent a room, and the overpopulation of cities like Tokyo today mean that the system has simply never gone away. The amount could be anything up to the equivalent of six months’ rent, though these days it’s usually around two. Despite the fact that more properties have recently started offering reikin-free entry, the practice remains widespread. Many property agents dealing with foreign companies know that it can be a rather alien concept to outsiders and instead of charging it upfront, split it into twelve and add it on monthly to the first year’s rent. All this means less money in your pocket during the difficult process of getting your business off the ground. Not so with SOHOs.

Sakura House asks for just two months’ rent – covering both a deposit and the first month’s lease – to get started, meaning your business can get off and running without shooting itself in the foot, something which can be all too easily done in the world’s priciest city.

As for the future of the SOHO industry, Mr. Aoyama sees a change coming. “To survive the competition, you have to have something unique, and I see the market splitting into two: Luxurious, serviced SOHOs and simple, low cost SOHOs. Really though, the most important thing for us is keeping it simple and in a good location.”

Location being as important as it is and space as scarce, one wonders how long it will be before capsule offices appear in Tokyo. Given the trend for miniaturization, however, the following might be a more likely scenario: offices in central Tokyo will get so small, they will disappear altogether and be replaced by virtual ones. It’s already starting to happen.

Story by Roddy Charles

From J SELECT Magazine, June 2010

Recent Comments